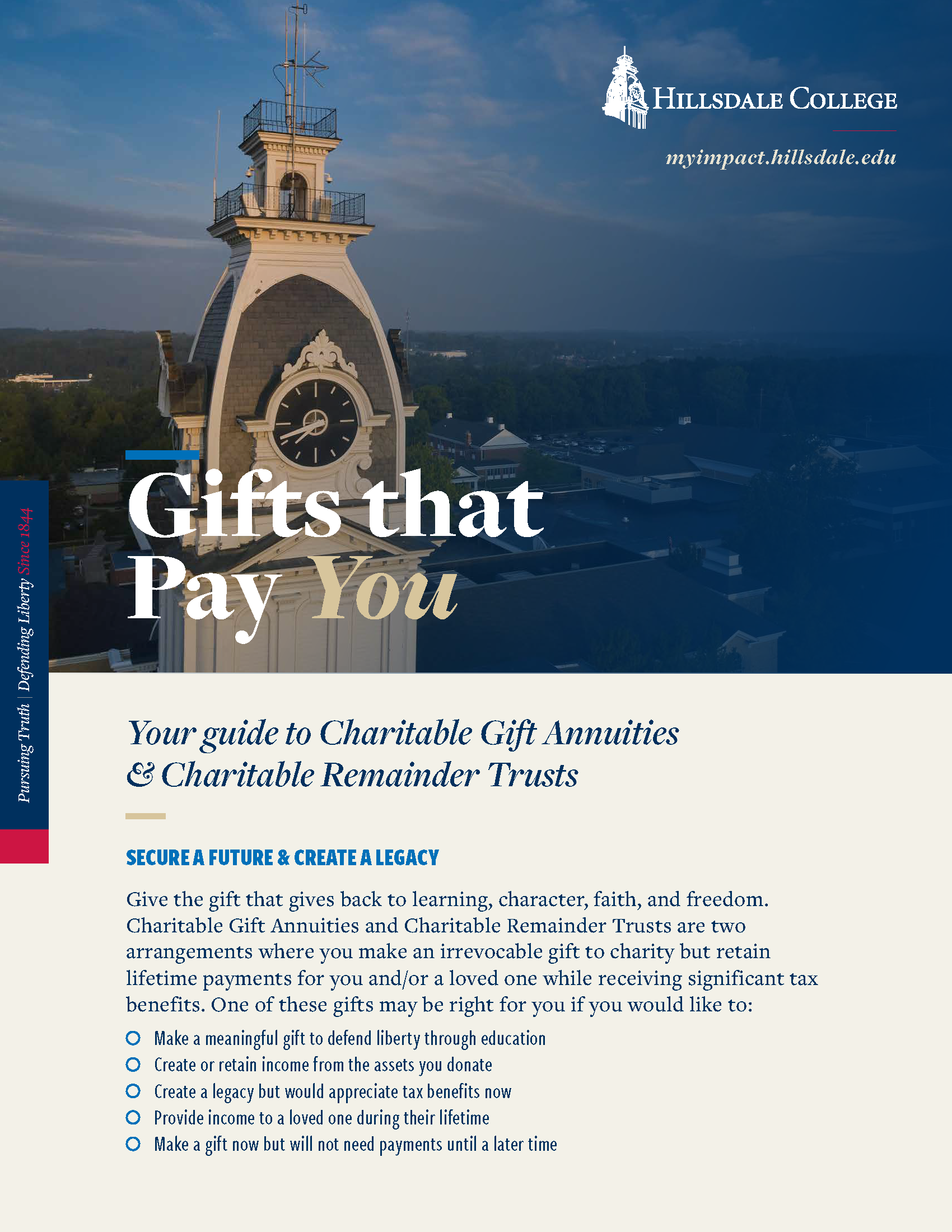

Gifts That Pay You Income

You can help secure your financial future or that of a loved one and create a legacy of learning, character, faith, and freedom with a gift that gives back. Charitable Gift Annuities and Charitable Remainder Trusts are two gift arrangements where you make an irrevocable gift to charity but retain lifetime payments for yourself and/or a loved one while receiving significant tax benefits.

Either option will help preserve truth and defend liberty by supporting a truly independent institution of higher learning that refuses EVERY PENNY of taxpayer support—even indirectly in the form of student grants or loans. NOT. ONE. PENNY—to remain independent without compromise.

You can learn more about these special opportunities in our free brochure, Gifts That Pay You, and other complimentary planning resources. These resources are just a click away!

Charitable Gift Annuities (CGA)

Charitable Gift Annuities (CGAs) offer a secure, fixed payment stream for yourself and/or a loved one for your lifetime(s). You will also receive tax benefits and the satisfaction of creating a lasting legacy of defending liberty through education.

How it works:

-

- You donate cash or appreciated securities worth $10,000* or more to Hillsdale College. In return, you and/or another beneficiary will receive fixed payments for life.

- Your payment rate is based on your age (payments start at age 60 or later) and will never change.

- A portion of your payments will be tax-free.

- The older you are—or the longer you defer starting your payment—the higher your payments will be.

*Note: Hillsdale College offers charitable gift annuities to residents of AL, AR, CA, HI, MD, ND, NJ, NY, TN, and WA via the National Gift Annuity Foundation (NGAF). The minimum investment amount is $20,000 through NGAF.

Benefits to you include:

You receive lifetime benefits that will never change.

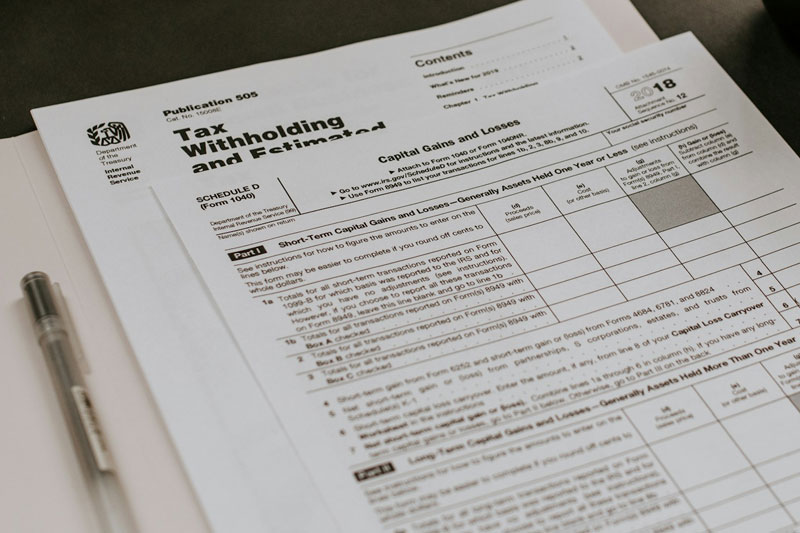

You may realize capital gains tax savings when you fund your CGA using appreciated stock.

You will be eligible for an immediate charitable income tax deduction.

Your gift passes to Hillsdale College outside of the estate process.

You create your legacy of defending liberty through education.

Charitable Remainder Trusts

A Charitable Remainder Trust (CRT) is a tax-free trust that pays you and/or other beneficiaries an annual distribution. This payment is either a percentage of the trust’s annual value or the original gift amount.

How it works:

- You transfer cash or an appreciated asset* into an irrevocable trust.

- The trustee (Hillsdale College) then sells the asset, paying no capital gains tax, and reinvests the proceeds.

- For the rest of your life (or a term of years), you and/or another beneficiary receive payments from the trust.

- After your lifetime, the remaining principal will support the mission of Hillsdale College.

* While donating real estate is the most common way to fund a charitable trust, a wide variety of assets can be used, including cash, appreciated publicly traded or closely held stock, and even oil, gas, or other mineral interests.

Benefits to you include:

You receive income for life for you and/or your heirs.

You receive a charitable income tax credit for the charitable portion of the trust.

You establish your legacy as a defender of the principles that made America so great and so free by supporting the work and mission of Hillsdale College.

From a Supporter Like You

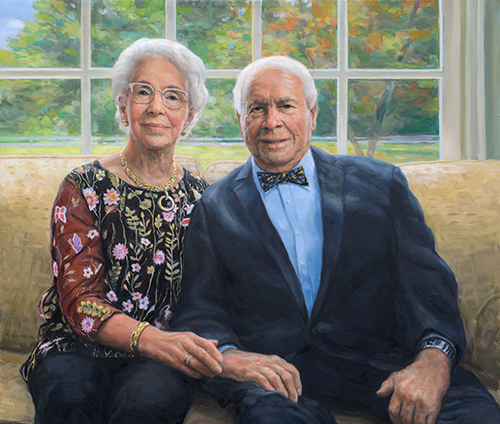

The Blake Center for Faith and Freedom, a satellite campus of Hillsdale College in Somers, Connecticut, was founded in 2020. When you visit, you can hear from speakers who discuss one of our country’s most essential principles—religious liberty. Pres and Helen Blake donated this beautiful property to Hillsdale in 2019 after learning about us through our free online courses.

I’m Here to Help

I am here to help you…

- Learn about special projects that align with your interests.

- Structure a donation that maximizes benefits for you and your loved ones.

- Stay up-to-date on how your gift is used.

- And more!